In short

- Many insurance companies are already using AI tools, with Chinese insurers leading the way in adoption and integration.

- Teams considering using AI still need to consider where the tech can best be used to improve productivity, before assessing the tool and model options.

- For insurance professionals who are just starting to experiment with generative AI, prompt engineering is a critical skill to learn. Plus, the model you use and the contextual information you provide can change the AI output significantly.

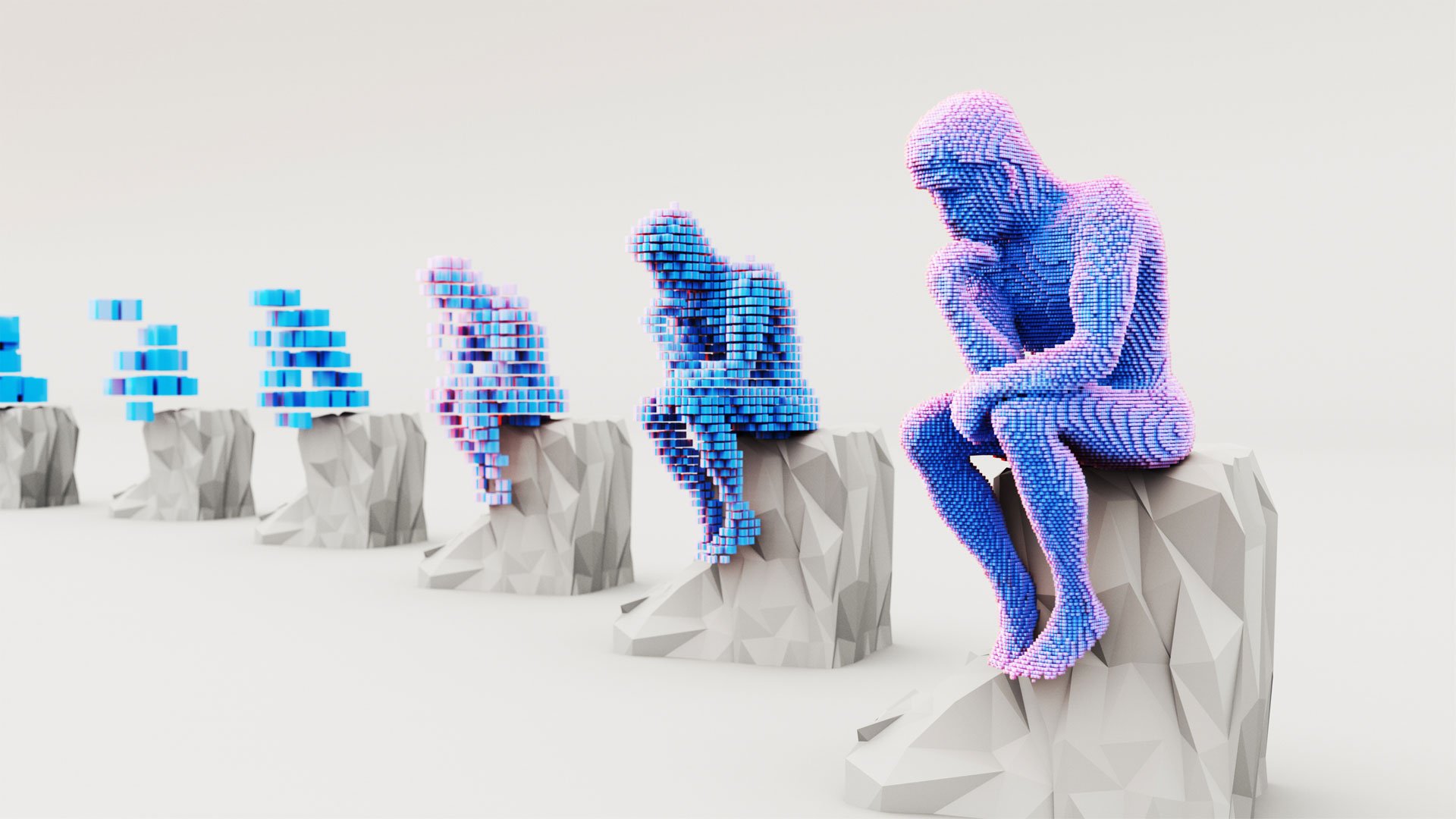

Three years after ChatGPT was launched on an unsuspecting world, the question is no longer whether generative AI will affect insurance, but how rapidly and profoundly it will transform the industry.

Chinese insurers have moved faster with AI than most of their global peers. A 2025 Society of Actuaries survey authored by Jian Gang He and Hong Li found just over 60 per cent of surveyed insurers already run large language model (LLM) applications in production, often co-developed with tech giants like Alibaba or Tencent.

While co-development is the norm, 62 per cent also build in house, with Alibaba’s Qwen a common partner. Looking ahead, it’s clear AI should be viewed not as an experiment but as essential infrastructure.

Insurers need to embed domain-specific tools into their everyday processes and partner with local tech ecosystems to accelerate deployment.

The practical use cases

Many of our current generative AI tools are particularly good at content creation, making them ideal for communications-related tasks.

“Most insurers are using AI in marketing, automating internal processes and improving day-to-day tasks like email responses or planning,” says Jane Barron, general manager of marketing and digital at Pinnacle Life.

For John White, head of sales and client services at Gallagher Bassett, the most significant impacts of AI for insurers have been in claims submission and triage.

“We’re seeing tools that can classify claims quickly, ensure they’re routed to the right manager, flag potential fraud and summarise key information to maintain continuity,” he says. “That allows the industry to stay responsive without losing the human touch required for complex handling of claims.”

The use cases among Chinese insurers are broad. AI chatbots now widely handle frontline customer queries; human insurance agents are equipped with tools that auto-generate marketing material and sales scripts; underwriters use LLMs to extract data from source records; and claims teams employ image recognition to assess car damage almost instantly.

Ping An, for example, has reported cutting average inspection times from hours to minutes. Insurers report efficiency gains of up to 80 per cent in targeted workflows.

Jeffrey Heaton is vice president of AI Innovation at Reinsurance Group of America and an adjunct instructor at Washington University in St. Louis. From Heaton’s observations, automation in triaging, fraud detection and customer service chatbots is now commonplace.

“Risk assessment is also gaining traction, with LLMs extracting structured data from messy, unstructured sources like medical reports or financial records,” he adds.

When asked about current best practice, White points to a recent experience he had with an AI-integrated claims platform.

“It could digest a product disclosure statement, a handwritten claim form, receipts and a claims guideline. Within seconds, it generated both a clear assessment of the claim and a draft letter to communicate next steps to the claimant,” he says. “That shows the power of embedding AI into workflows.”

Heaton is excited by what some of the larger players are doing. “Some global reinsurers and carriers are building internal AI centres of excellence that bring together data scientists, actuaries, underwriters and compliance teams,” he says.

“What’s impressive is the focus not just on the technology but also on the governance. There are clear pipelines for use cases, rigorous model validation and alignment with regulators.”

Understanding the business case for AI

While the insurance industry has been comparatively quick to adopt AI, all the usual benefits and challenges of any new technology — emerging risks, liability issues, regulation and governance requirements, change management and staff training — apply.

Teams that have yet to integrate an AI tool into their workflow should first identify the routine, low-risk tasks where generative AI could save them significant time.

“There’s no point in using AI for the sake of it,” says Barron. “There has to be a clear benefit, whether that’s increased quality or productivity.” Heaton agrees. “Projects fail because they launch without clear business goals, underestimate data quality issues or lack stakeholder buy-in,” he says.

“The successful ones tie use cases directly to KPIs, invest in data integration and educate employees.”

One of generative AI’s biggest drawcards is that basic tools can be trained on the huge quantities of data insurers typically have to create bespoke AI tools in different functions.

This also means the usefulness and accuracy of the resultant tool are reliant on the quality of that data and how well it’s structured. “The biggest mistake I see is thinking AI is plug-and-play,” says White. “It needs proper set-up, training and ongoing checks.”

Barron urges insurers not to rush the planning stage. “Before releasing anything, test and test again,” she advises. “Be really clear about why AI is the solution and what its risks and limitations are. That’s the sensible way to approach any new technology.”

What’s coming next

The emergence of agentic AI which can operate semi-independently of humans for certain tasks, demonstrates just one direction AI development is taking.

White is bullish about AI moving deeper into client relationships. “Over the next five to 10 years, I expect AI to evolve into a real-time assistant that personalises outreach, automates follow-ups and anticipates client needs. It could act like a strategic partner, helping us deliver faster, smarter services.”

Heaton points to more advanced applications on the horizon. “Quantum-enhanced machine learning could speed up complex underwriting calculations across thousands of variables,” he says. “We’ll also see regulatory tools that embed monitoring directly into workflows.”

Tips for the later adopters

When any transformative technology emerges, there are always those who immediately and enthusiastically embrace it and those who don’t. If you’re in the latter camp, here are some tips from our experts on how to leverage generative AI more effectively.

Your starting point is which generative AI tool to use. That selection might already be guided by your company’s existing tech partner. In China, locally trained models such as DeepSeek dominate, with others including Qwen, ERNIE, Spark and Zhipu GLM also in use.

In other countries, Microsoft Copilot, Google Gemini, Claude, ChatGPT, Willow and EXL’s NVIDIA might be more common options.

Different models may provide different results. The free, publicly available options may also use your inputs in other people’s future outputs, making bespoke tools essential for insurers to mitigate privacy risks.

Says Barron: “Insurance, particularly life, involves highly personal data, so companies are rightfully careful about what they expose to AI.”

Heaton points out that, even if they don’t realise it, most insurance professionals have ready access to generative AI tools such as Microsoft 365 Copilot built into existing business systems, and many already use it for tasks like drafting emails.

“That’s a low-risk way to build AI literacy day to day,” he says. Prompt engineering is key to getting the best, most relevant and useful results from current generative AI models.

“Give the AI you’re using a role and context, and let it know what response — a summary, email, bullet points, graph — you want,” White advises. “Then ask follow-up questions to refine the output.

“An effective prompt could be something like: ‘You are a senior claims consultant at a general insurance company. Draft a detailed internal summary of a complex property damage claim involving multiple parties, disputed liability and incomplete documentation. Include a timeline of events, key issues, recommended next steps and potential risks to the business.

Now, prepare the recommendations in a report suitable for an internal management review’.” Barron adds:

“Treat AI like a colleague. Provide as much context as possible and don’t be afraid to challenge it. Also, be aware that including details like your market or jurisdiction in prompts can change the results entirely.”

Writer's insight

As a journalist, I’ve already adapted my workflow to generative AI. It hasn’t all been upside but it has stripped out much of the repetitive grunt work that once clogged up my day. That’s freed up considerable time for deeper thinking. I suspect something similar will play out in the insurance industry and, eventually, most industries. Increasingly, AI will handle the routine stuff, freeing humans to concentrate on activities that require creativity, judgement or empathy.

Comments

Remove Comment

Are you sure you want to delete your comment?

This cannot be undone.