In Vietnam’s rapidly evolving economy, life insurance advisers must transform into something more than product sellers.

We must become personal financial planners; professionals who accompany clients on their journey toward security, financial freedom and sustainable prosperity.

Life insurance today is no longer just a protection product. It is a core component of every individual’s financial landscape, a bridge connecting short-term stability with long-term goals.

This shift demands a new mindset, broader knowledge and deeper professional ethics. The modern adviser must integrate financial planning, risk management and sustainable values to create solutions that truly serve the client’s life – not just the company’s quarterly target.

Vietnam’s changing financial environment

Over the past decade, Vietnam has seen extraordinary growth in both personal wealth and financial complexity.

People now manage portfolios that combine savings, loans, securities, real estate and insurance. As someone who studies financial behaviour, I see clearly that our clients’ needs are no longer basic. They are strategic and aspirational.

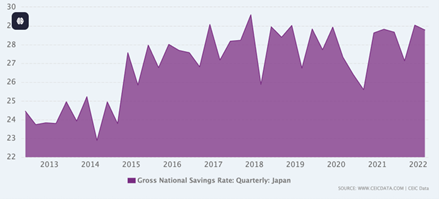

Savings rate trends in Vietnam compared with Australia and Japan

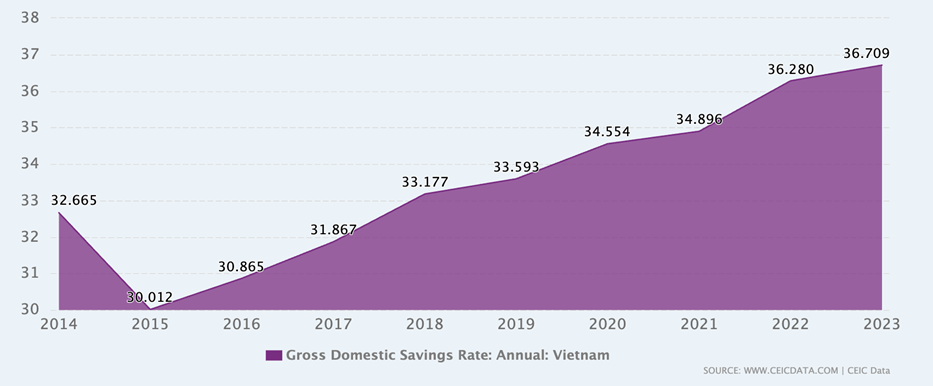

Vietnam’s savings rate is among the highest in Asia, showing a strong desire for financial security and future planning.

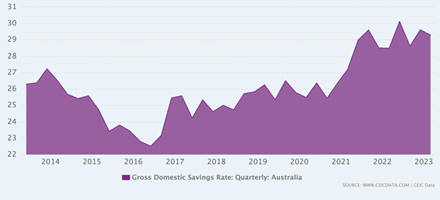

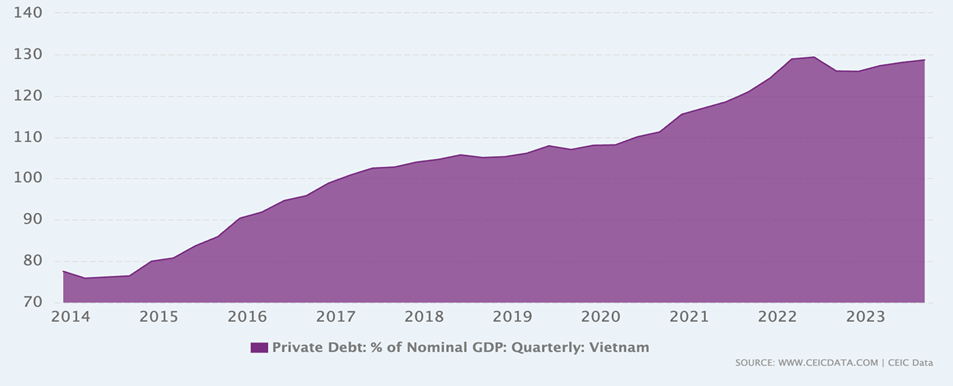

Yet household debt has also risen sharply, especially through real-estate loans and consumer credit. This dual reality, high savings alongside high leverage, creates both opportunity and risk.

Private debt as percentage of GDP in Vietnam

Meanwhile, securities trading volumes have surged. More Vietnamese investors are seeking higher returns, diversifying beyond bank deposits.

At the same time, life insurance premium revenues continue to rise steadily. These trends demonstrate that individuals are willing to invest for the future but need guidance to balance risk, liquidity and protection.

Source: Insurance Supervision Authority – Ministry of Finance, Vietnam Insurance Association (2024)

Growth of life insurance premium revenue in Vietnam

Supply meets rising expectations

On the supply side, Vietnam’s financial ecosystem has matured. We now have dozens of fund management companies, a growing range of open and ETF funds, and more than twenty life insurers operating nationwide.

|

Year |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

|

Open funds |

19 |

22 |

25 |

32 |

34 |

39 |

52 |

56 |

58 |

|

Quỹ đống |

1 |

1 |

2 |

2 |

2 |

2 |

2 |

3 |

3 |

|

Member funds |

8 |

10 |

10 |

10 |

13 |

17 |

31 |

32 |

33 |

|

ETF funds |

2 |

2 |

2 |

2 |

7 |

8 |

11 |

14 |

15 |

|

Real estate funds |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

|

Total |

31 |

36 |

40 |

47 |

57 |

67 |

97 |

106 |

110 |

|

Fund management companies |

47 |

46 |

46 |

45 |

44 |

44 |

44 |

43 |

43 |

|

Total assets (nghìn tỷ) |

7.77 |

14.53 |

22.48 |

32.60 |

57.69 |

84.96 |

68.69 |

68.07 |

Growth in fund management companies and assets under management (2016–2024)

This diversity benefits consumers but also increases confusion. Each product, whether stocks, bonds, real estate funds, pensions, or insurance, serves a different purpose, and few clients have the expertise to integrate them effectively.

That integration is our new professional mission. However, the financial advisory field remains fragmented. Each sector – insurance, securities, real estate – requires its own certificate under different laws. There is no unified qualification that ensures comprehensive financial planning capability.

Training often focuses narrowly on selling the company’s products rather than designing holistic solutions. This gap between clients’ complex needs and advisers’ limited preparation must be bridged if we are to achieve sustainable development in the life insurance industry.

Life insurance as part of a holistic plan

When I speak to clients, I remind them that life insurance is not only about protection. It is about enabling life’s ambitions. A modern life policy supports five critical goals:

1. Protection: Safeguarding the family’s income if the breadwinner can no longer work.

2. Savings and investment: Combining protection with disciplined accumulation for major life milestones; education, housing, or retirement.

3. Health security: Covering medical expenses through supplementary health riders to prevent financial shocks.

4. Peace of mind: Providing emotional stability that allows people to focus on work and family.

5. Financial empowerment: Supporting long-term dreams, from entrepreneurship to legacy planning.

In the past, insurance selling often relied on fear: illness, death, or loss. Today, clients aspire to control, growth and freedom. They no longer buy out of fear; they invest for empowerment.

This is consistent with Maslow’s hierarchy of needs and behavioural models such as the Theory of Planned Behavior. As values evolve, so must our approach.

From seller to planner

To serve this generation, we must think and act like true personal financial planners. A person’s financial life follows a cycle: earning, saving, protecting accumulated wealth, investing (generating wealth from money) and reaching safety within financial freedom.

Life insurance intersects every stage, from protecting income to building retirement capital and ensuring inheritance. Our role is to integrate insurance into each phase strategically.

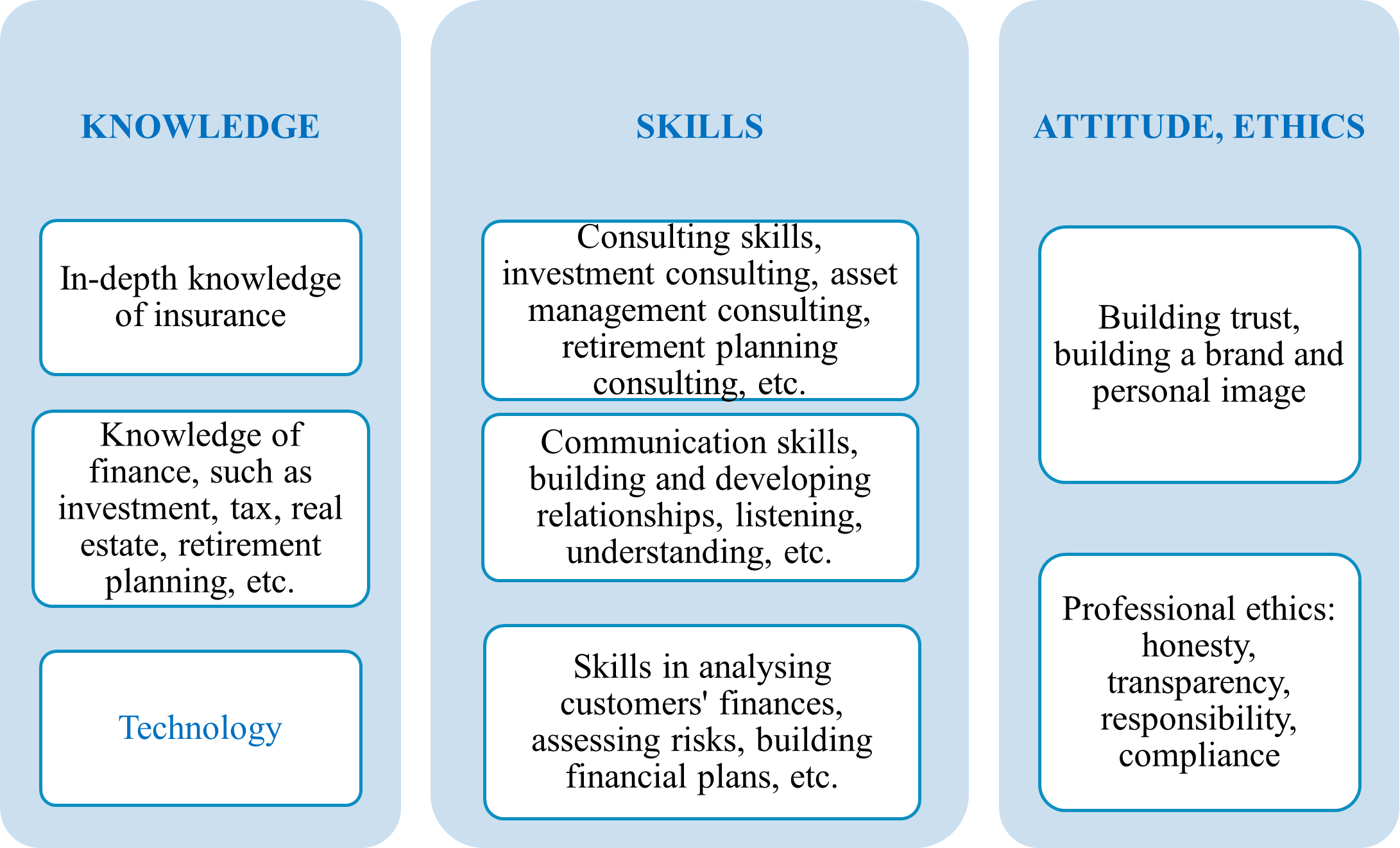

That requires more than product knowledge. It calls for mastery of financial analysis, tax implications, investment principles and the psychology of money. It requires empathy, integrity, and the ability to translate complex financial ideas into simple, meaningful advice. In short, it demands that we become educators as much as advisers.

The sustainable path forward

Sustainable development in life insurance is not only about company profits or regulatory compliance. It means creating long-term value for clients, society, and the economy.

For advisers like myself, sustainability begins with professional ethics. This means putting the client’s benefit first with a commitment to continuous learning. Yet, challenges remain.

Advisers must balance client benefit and personal income, ensuring advice leads to suitable, enduring contracts. They must meet business targets while staying focused on the client’s wellbeing. Achieving both requires personal discipline and institutional support.

Dual responsibilities: adviser and enterprise To overcome these challenges, both advisers and companies must evolve together.

For advisers, three capabilities are essential:

- Digital literacy: mastering technology to serve clients efficiently and transparently.

- Soft skills: communication, empathy and listening to truly understand client goals.

- Client-centric mindset: measuring success not by commissions but by client satisfaction and retention.

For businesses, several strategies are key:

- Diversification of product portfolios to meet a broader range of financial goals.

- Making training in comprehensive financial planning a priority, rather than just product sales.

- Using technology to assess clients’ financial health and personalising recommendations.

- Building fair compensation systems that reward ethical, sustainable advice.

When advisers and enterprises align in this way, we can build a truly professional, respected, and sustainable industry – one that earns public trust and supports Vietnam’s broader economic goals.

Conclusion: Redefining professionalism

The Vietnamese life insurance industry stands at a turning point. The profession must redefine itself – not as a sales force, but as a community of trusted planners who help clients navigate complex financial realities with wisdom and care.

As I see it, our mission is not to sell protection, but to protect dreams. To do this, we must cultivate knowledge, skills, and ethics worthy of that trust.

Continuous learning, adaptability, and integrity will determine not only our individual success but the sustainable growth of our entire industry.

Final reflection

In this new era, life insurance is no longer the end of a financial plan. It is part of the journey.

The Vietnamese adviser who embraces this holistic, ethical, and sustainable approach will not just survive; they will lead. And that, I believe, is the true profile of the personal financial planner of the future.

Comments

Remove Comment

Are you sure you want to delete your comment?

This cannot be undone.