If you are feeling a case of déjà vu after reading this headline, you are not alone. Just over two years since the unfair contract terms (UCT) regime came into effect for insurance contracts, the legislation has been revamped, and has been live since 9 November 2023. Insurers are yet again reviewing insurance contracts that may now be caught by the regime.

The latest UCT provisions of the Treasury Laws Amendment (More Competition, Better Prices) Act 2022, update the Australian Securities and Investments Commission (ASIC) Act 2001 to expand the operation of the UCT regime.

Similar changes have been made to the Australian Consumer Law (ACL), which also came into effect on 9 November 2023. This article considers the changes to insurance contracts required under the ASIC Act.

The threshold tests and maximum penalties are different between the ACL and the ASIC Act.

Changes to consider

The main changes affecting insurance contracts are:

- expanded application of the UCT regime to a larger number of consumer and small business standard form insurance contracts

- introduction of a civil penalty regime prohibiting the use of and reliance on UCTs in standard form contracts

- clarification of the power of the courts in relation to UCTs

- provision if a lifeline for certain life insurance policies.

The new UCT regime applies to any insurance contract made or renewed on or after 9 November 2023. For insurance contracts that are only varied (and not made again or renewed) on or after 9 November 2023, the new regime will apply to the extent of the varied term. Medical indemnity insurance continues to be exempt from the UCT regime.

The amendments create some uncertainty for insurers. The significantly expanded thresholds under the small business test will increase the reach of the UCT regime.

Given the difficulties of verifying whether a business falls within or outside the relevant thresholds, conservative insurers may seek to ensure that all standard form insurance contracts have been reviewed for UCTs.

What is the context?

Until 2021, insurance contracts were excluded from the UCT regime in the ASIC Act. On 5 April 2021, the UCT regime in the ASIC Act was expanded to include standard form insurance contracts issued to consumers and small businesses.

For a refresher on what might be considered an “unfair”’ term, see the previous article published on Norton Rose Fulbright's website.

In the lead up to 5 April 2021, ASIC undertook proactive regulatory activity, working with several insurers to make changes to insurance policies. Some examples of changes that were made include:

- removing terms that gave insurers unilateral discretion

- removing terms that were an unnecessary barrier to an insured person lodging a claim

- extending certain timeframes in policy conditions that may have been impractical

- amending terms to provide greater collaboration between the insurer and the insured around decision making processes

- qualifying overly broad terms so that they are only applied in specific situations.

What changed?

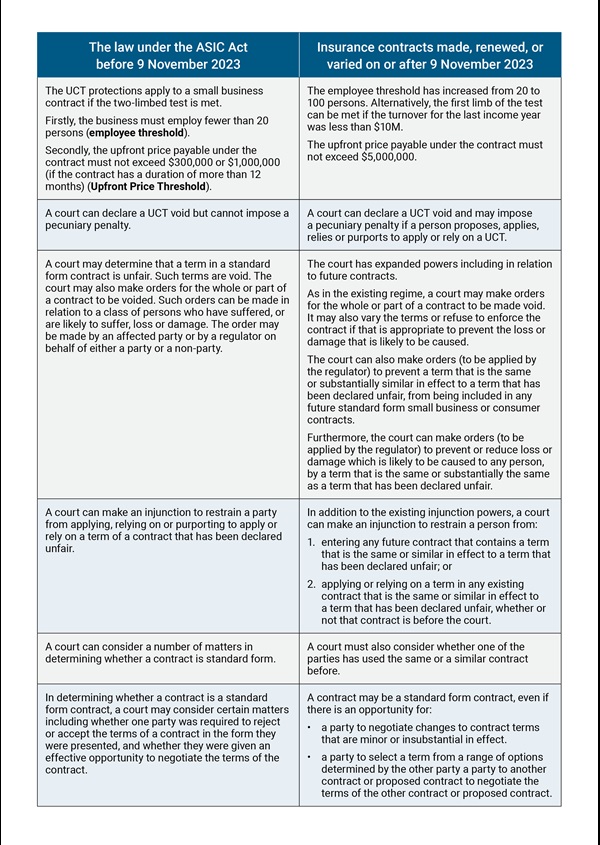

From 9 November 2023, the following changes took place in relation to the UCT regime under the ASIC Act:

Civil penalties

From 9 November 2023, a contravention of the UCT prohibitions under the ASIC Act can attract significant civil penalties. This is a new feature of the UCT regime. Prior to the update, a court could declare a term to be void but could not order civil penalties. The maximum penalty for a body corporate will be the greater of:

- 150,000 penalty units (presently $15,650,000)

- the amount of the benefit derived, and detriment avoided because of the contravention, multiplied by 3

- 10 per cent of the annual turnover of the body corporate for the 12-month period ending at the end of the month in which the body corporate contravened or began to contravene the civil penalty provision capped at 2.5 million penalty units (presently $782,500,000).

The civil penalty regime creates a significant incentive for insurers to ensure their contracts do not have UCTs, and where terms may be subject to challenge, they can justify the term by showing they are protecting a legitimate interest.

A lifeline for life insurance policies

Under the new section 12BLA of the ASIC Act which came into effect on 9 November 2023, there are special provisions applicable to life policies within the meaning of the Life Insurance Act 1995 (Cth).

The UCT amendments mentioned above do not apply to a life insurance policy that was entered before 5 April 2021, which has since been replaced by another policy for the following reasons:

- the replacement policy reinstates the previous policy and is issued at the request of the owner of the previous policy after the previous policy has lapsed

- the replacement policy is a reissue of the previous policy to correct an administrative error in the previous policy

- the replacement policy is issued at the request of the owner of the previous policy for one or more of the following reasons:

- to change the ownership of the policy

- to extend or vary the cover provided under the policy by term of the previous policy;

- to change the terms relating to premiums paid under the policy; or

- to link or unlink certain existing policies.

Linking and unlinking policies refer to a situation where the policyholder seeks to change the structure of the policy by connecting it with or separating it from another policy.

An example of unlinking is when a consumer decides to separate a combined TPD and death cover into two separate policies where a claim under one policy does not affect the sum insured under the other.

Conversely, an example of linking is the conversion of two standalone policies (for example TPD and death policies) into one combined policy.

The introduction of civil penalties to the UCT regime may result in insurers refusing to respond to consumer-initiated requests relating to life products because it could trigger UCT risk for the replacement policy.

The exemptions aid in avoiding these potentially negative outcomes for customers. Interestingly, the exemptions do not apply to variations of existing policies and only ‘replacements’.

What's on the horizon?

We expect to see ASIC undertake more enforcement action in relation to UCTs given its expanded regulatory toolkit.

If they have not already, insurers should review all affected insurance policies since the scope of the regime has broadened and there is now the risk of civil penalty action for including UCTs in policy wordings.

ASIC has already launched two proceedings against insurers under the current regime alleging potential UCTs in insurance policies:

- In April 2023, ASIC issued proceedings against Auto & General Insurance concerning an obligation that required insureds to notify the insurer if "anything’ changed" to their home and contents. ASIC’s case against Auto & General includes that the contract did not explain the effect of section 54 of the Insurance Contracts Act 1984, which may assist the insured if they did not comply with their notification obligations.

- In May 2023, ASIC issued proceedings against HCF Life regarding a "pre-existing condition" contract term that was potentially inconsistent with section 47 of the Insurance Contracts Act.

For policyholders, the expanded regime (especially the changed threshold for small businesses) may mean that insurance contract terms are now susceptible to challenge under the new UCT regime, when previously they were not within its scope.

This article first appeared on the Norton Rose Fulbright Regulation Tomorrow Blog. It is reproduced here with permission.

Comments

Remove Comment

Are you sure you want to delete your comment?

This cannot be undone.