LGBTIQA+ people have come to expect the discrimination they regularly experience when applying for insurance products or making claims, according to InsurePride’s recent Worth the Risk survey of 493 lesbian, gay, bisexual, transgender, intersex, queer and asexual (LGBTIQA+) insurance consumers.

Many respondents reported very negative experiences, including being harassed and harangued, and called offensive names.

“I once had a call operator project their religious opinions about living in a same-sex household,” one respondent reported.

Another described “knowing that transphobia is very likely to be encountered and having to mentally prepare for it”, [1] while a third shared “the headache of having to explain trans101 to someone in a call centre, and “the fear that there will be some loophole that I'll be denied service because of being trans”. [2]

A lack of understanding

Such “discrimination, exclusion and poor treatment by insurance providers is often due to a lack of understanding and sensitivity towards LGBTIQA+ issues,” says Paul Bennell, co-chair of InsurePride, the insurance industry network for LGBTIQA+ professionals, partnerships and allies.

“LGBTIQA+ individuals often face unique challenges when interacting with service providers, including potential biases, or outright discrimination,” Bennell says.

Discrimination is the biggest barrier to accessing or utilising insurance for many of the 207 trans or gender diverse insurance consumers who responded to the Worth the Risk survey [3].

Due to the level of hostility often experienced, trans and gender diverse insurance professionals and consumers feel unsafe speaking openly, so, their comments and responses in the InsurePride survey were reported anonymously.

Ongoing discrimination a disservice

In addition, when dealing with the insurance industry, trans, gender diverse or non-binary customers say the discrimination they feel isn’t a once-off scenario or an aberration.

They say the regularly of their experiences leave them feeling disrespected and frustrated about being excluded and the lack of awareness within the industry.

For example, LGBTIQA+ insurance consumers are often subjected to assumptions about their names, genders, relationships, families and living arrangements.

“Staff attitudes and assumptions about kids and family and living arrangements is a significant barrier to accessing and utilising insurance,” the Worth the Risk report found.

As one respondent commented, “Every time I call my insurance company regarding my contents insurance, which I share with my same-sex partner, they misgender her. The first insurance card they sent her had her title wrong (they printed it as Mr), despite my explaining it multiple times. They still get it wrong."

Another respondent stated that their insurance company constantly assumes their partner is of the opposite sex.

“Insurance companies have always assumed my sexual orientation and used heteronormative language,” a third respondent said.

Never make assumptions

Many insurance professionals also make assumptions, often incorrectly, based on the voice or appearance of the customer.

“They assumed my gender based on my voice and proceeded to call me ‘sir’ throughout the conversation,” one respondent said. “Perhaps pronoun training or genderless pronouns/ titles are needed to make it a more comfortable experience for all,” they added.

Consistent assumptions and exclusionary language go beyond rudeness. They can also result in inappropriate or inaccurate information disseminated or collected about insurance products or options.

“Insurance companies have been unsure when I have asked questions specific to their products, such as health insurance, and myself and partner purchasing these products as a same-sex couple,” one respondent reported.

InsurePride agrees and urges insurers not to make assumptions about people’s names, genders, relationships, families or living arrangements.

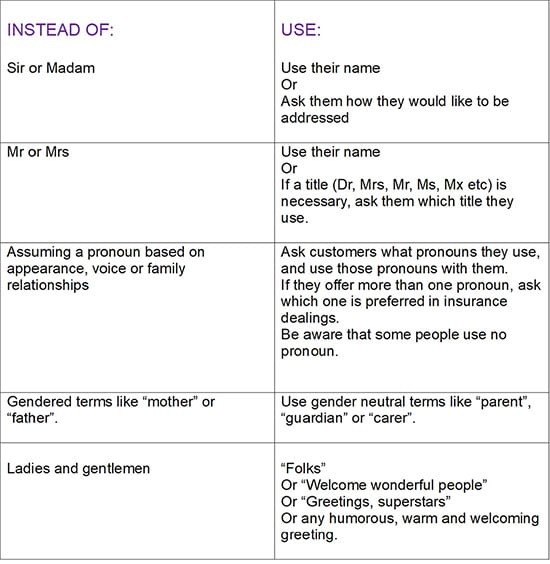

Insurers are also urged to use inclusive language. Asking the customer how they would like to be addressed validates the customer and avoids the awkwardness of inappropriate words or assumptions, making the experience more comfortable for everyone. Some suggestions include:

[1] Anonymised Worth the Risk survey respondent

[2] Anonymised Worth the Risk survey respondent

[3] Worth the Risk: LGBTIQA+ experiences with insurance providers Report, 2022, p. 22

Mistakes happen...then what

Even with the best intentions, mistakes may happen, especially when using unfamiliar pronouns, or where you have known the person by different names or pronouns in the past. In those situations, it is important to correct yourself out loud and move on.

“Lengthy apologies aren’t necessary and shift the focus to your experience rather than to the person who was misgendered,” advises the Human Rights Campaign. “The best apology acknowledges the error without making the other person feel the need to comfort or reassure you that they are ok.” [1]

Rainbow Health Australia’s guide to inclusive practices for non-binary clients [2] provides some helpful suggestions for face-to-face appointments:

“If you cannot pronounce their name or you cannot recognise anyone in the waiting room, a suggestion would be to call out, '11 am appointment please?’

"Or you could require each person to take a ticket when they arrive at your practice, so when you call out that person, you are only calling out the number. This promotes privacy and respect for the time it may take to get to know your client, before making any assumptions that might be disrespectful.”

Disclosing sexuality or gender identity can be an unpleasant experience. In the words of one respondent, “I do disclose my sexuality by default, but it sucks having to have the same conversation over and over again.

"And the person on the end is clearly so uncomfortable getting it wrong — they've had no training in how to cope in that situation. A simple apology and move on would be preferable, or just not assuming in the first place.”

No one should expect hostility

Many transgender respondents have experienced so many ignorant or offensive comments in the past, that they expect to encounter hostility when disclosing that they are transgender.

InsurePride found concerning incidents of insurance customers being mocked and called offensive names.

The Worth the Risk Report notes, “Unfortunately, some respondents reported being laughed at when seeking to change their name or gender marker… In one case, a trans and gender diverse respondent told us they were referred to as a ‘pervert’ by their insurer.” [3]

A large proportion of trans and gender diverse respondents anticipated and confronted transphobia from insurance companies when updating their name and gender.

Over 70% had difficulty updating their or their partners’ or families’ names and genders. [4] The process to do so is not smooth or easy and is often drawn out over a long time.

76% of trans and gender diverse respondents “have had difficulty self-declaring their gender with insurers,” the report found. In addition, “72% have had difficulty updating their name and other information with insurers; and 69% have had difficulty updating partner or family information with insurers.” [5]

“Often it can take a considerable amount of time and constant contact for a trans and gender diverse customer to update their name and gender, with customers often having to submit copious documents and other information, often authenticated by witnesses," the report says.

"This is despite the General Insurance Code of Practice stating that, when it comes to identification requirements, verification and identification will be flexible.” [6]

It is not surprising that respondents called for customer-facing staff to undergo training in working sensitively, effectively and respectfully with trans and gender diverse consumers. [7]

Respondents also described the difficulty, discomfort and loss of time in having to deal with more than one customer service representative. In addition to having to repeat personal information, consumers risk confronting transphobic responses from each new contact.

As one respondent said, “I would prefer it if this could be done via a self-service online portal where you provide a self-declaration of your change of name/gender without needing to call the insurer and wait on hold and risk discrimination/adverse comments from the operator.” [8]

The Worth the Risk Report recommends that “insurers review their process to ensure that a customer who is changing their name, gender or title need only speak to one customer service representative.” [9] (Recommendations 12, 14 and 15).

InsurePride also argues that insurers should review their practices on the collection of data regarding sex and gender and only collect information if it is absolutely necessary.

Maintaining professionalism

In their dealings with the insurance industry, LGBTIQA+ customers also regularly experience intrusive questioning on private information that is not relevant for insurance purposes.

“Literally changing my name with insurers always opened me up to the "and why that name?" question, which may be innocuous to the person asking, but it's just an awkward situation every. damn. Time,” one respondent said.

Anti-bias training, and training on working with LGBTIQA+ customers will make insurers’ processes and products more sensitive and inclusive. The Worth the Risk report found that training of insurance professionals is the most effective way to bring about change.

“Training service and sales staff on the existence, experiences, and needs of LGBTIQA+ insurance consumers are essential to creating an inclusive and equitable environment,” says InsurePride’s Bennell.

“Educating staff on these issues can significantly enhance the customer experience, build trust, and ensure that the insurance services provided meet the diverse needs of all consumers. Furthermore, it aligns with broader corporate social responsibility goals and the increasing emphasis on diversity and inclusion within the industry."

Bennell suggests a variety of training approaches." (See below.)

[1] https://www.hrc.org/resources/be-an-ally-support-trans-equality

[3] Worth the Risk, p. 22

[4] Worth the Risk, p. 24

[5] Worth the Risk, p. 24

[6] Worth the Risk, p. 25, citing Insurance Council of Australia, General Insurance Code of Practice (2021), p. 32

[7] Worth the Risk, p. 25

[8] Anonymised Worth the Risk survey response, cited in Worth the Risk Report, p. 25

[9] Recommendation 15, Worth the Risk Report, p. 26

InsurePride advises that “Insurance providers can train staff through a variety of methods, including:

- Workshops and Seminars: These can provide in-depth, interactive learning experiences where staff can engage directly with LGBTIQA+ trainers and community members to better understand their perspectives. Pride in Diversity run regular forums that member organisations can leverage.

- Digital Training Modules: Online courses or e-learning platforms can offer flexible training options that staff can complete at their own pace.

- Guides and Manuals: Providing staff with written resources, such as guides or manuals on LGBTIQA+ inclusion, can serve as a reference for daily interactions. Incorporating training into onboarding processes including LGBTIQA+ sensitivity training as part of the onboarding process for new employees ensures that awareness and understanding are foundational elements of the company culture.

- Guest speakers and panels: Inviting LGBTIQA+ community organisations, like InsurePride and members to speak about their experiences can personalise the training and provide valuable insights.

Building empathy

It has also been recommended that insurers assign LGBTIQA+ staff to work with LGBTIQA+ customers, as this may build empathy and positive perception for the customer.

"Employing LGBTIQA+ staff will also build awareness within the team or the company. However, it is crucial that LGBTIQA+ staff be compensated for any additional work or responsibilities they take on in terms of building LGBTIQA+ inclusivity, and that they are provided with support when confronting hostility," Bennell says.

"It is also important that the burden not fall solely on LGBTIQA+ staff." Employing dedicated LGBTIQA+ staff supports, but does not replace, the need for all insurance professionals to be inclusive and aware.

Insurers make real improvements

While InsurePride’s Worth the Risk report found many examples of negative experiences for LGBTIQA+ insurance customers, there are promising signs that the culture is changing, with many respondents also reporting positive experiences.

“52% of respondents believe insurance companies are trying to understand and respect LGBTIQA+ people,” the Worth the Risk report found.

“Each company when I have disclosed my transgender background have been incredibly accommodating and supportive, asking no more questions than absolutely required to process the request,” [1] said one respondent.

Another respondent described positive experiences such as “my gender identity being recognised, and feeling like I can select what I align with most without fear that it could invalidate my policy.” [2]

These responses demonstrate that it is possible to develop processes that are respectful and supportive of LGBTIQA+ consumers. Encouragingly, “LGBTIQA+ inclusive practices within the Australian insurance industry have been growing, with several companies taking significant steps to create more inclusive environments and products,” says Bennell.

He offers some examples:

- Pride in Diversity membership: Many Australian insurance companies, including major players like Suncorp, Allianz, and TAL, are members of Pride in Diversity. This organisation works with employers across various sectors to improve the inclusion of LGBTIQA+ employees in the workplace. Membership indicates a commitment to fostering inclusive cultures and implementing best practices to support LGBTIQA+ staff.

- Diversity and Inclusion (D&I) policies: Companies such as QBE Insurance have established comprehensive diversity and inclusion policies. These policies explicitly support LGBTIQA+ employees by promoting an inclusive culture, ensuring equal opportunities, and providing specific support networks. They also involve internal employee resource groups that offer a safe space for LGBTIQA+ employees to connect, share experiences, and advocate for further inclusivity.

- LGBTIQA+ inclusive products: Some insurers have started reviewing and adjusting their products to be more inclusive of LGBTIQA+ customers. For instance, Allianz has been working on ensuring that their life insurance policies are more inclusive of same-sex couples and non-binary individuals, making sure that benefits and coverages are appropriately adjusted. Another positive example is the life insurance industry reforming underwriting for people living with HIV — due to these changes, 30,000 members from this community can now access life insurance.

- Supporting LGBTIQA+ causes: Insurance companies have also shown their support through sponsorships and partnerships with LGBTIQA+ events and organisations. For example, some companies have sponsored events like the Sydney Gay and Lesbian Mardi Gras, showing public support and visibility for the LGBTIQA+ community.

- Training and Education: TAL, Zurich, Bupa and QBE, among others, have rolled out training programs for employees to raise awareness and understanding of LGBTIQA+ issues. This training aims to reduce unconscious bias and ensure that all employees, regardless of sexual orientation or gender identity, feel safe and respected in the workplace.

- Employee Benefits: Insurers like Zurich have reviewed their employee benefits to ensure they are inclusive of LGBTIQA+ employees. This includes offering gender affirmation leave, as well as health and well-being benefits that cater to the specific needs of LGBTIQA+ staff, as well as ensuring that family and parental leave policies are inclusive of all family structures.”

InsurePride recognises that these initiatives are steps toward greater inclusivity and notes that there is still some progress to be made.

“The ongoing challenge remains to ensure that these practices are not just performative but are deeply embedded in the corporate culture, benefiting both employees and customers alike,” Bennell says.

[1] Anonymised Worth the Risk survey response

[2] Anonymised Worth the Risk survey response

Comments

Remove Comment

Are you sure you want to delete your comment?

This cannot be undone.