We are all facing the impact of inflation in different ways, and the home contents space is no exception.

While the cost of settling claims for most retail goods— from furniture to clothing — has felt the squeeze, there’s one kind of loss that “shines” differently: jewellery.

Surprisingly, the average cost of replacing jewellery has decreased, defying the trend across other household items.

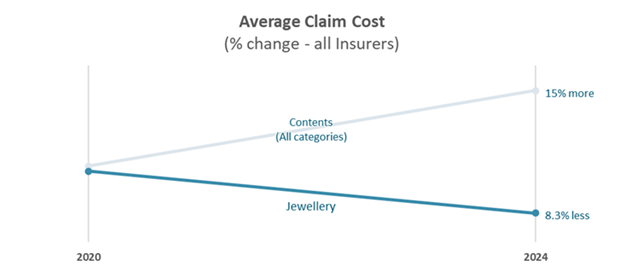

Contents claims have increased by 15% since 2020, according to Sum Insured’s 2024 Residential Contents Index (RCI), with many categories accelerating faster than typical annual inflation. It’s no surprise that insurers are being forced to re-evaluate how they settle contents claims.

Figure 1 - Jewellery claims are decreasing in cost.

Given the need for specialist input and the high levels of emotion attached, jewellery claims are certainly one of the more unique insurance categories.

They are also notable for spend patterns, having seen an 8.3% decrease over a 5-year period (2020 – 2024) across a sizeable volume of claims (54,000).

It’s somewhat ironic that luxury goods are potentially improving insurance affordability - especially in a climate where most other household categories face double-digit inflation.

This unexpected trend has already piqued the interest of many insurers, prompting them to take a closer look at why jewellery is bucking the inflationary tide.

1. Broader Inflationary Pressures

Before we can look at the jewellery category specifically, it is helpful to understand just how much we have been navigating persistent inflation in consumer goods during that 2020-2024 period.

Between June 2020 and December 2024, Australia’s peak reported inflation was 7.8%, and New Zealand saw similar highs, with 7.3% .

Although inflation is showing signs of slowing down, supply chain disruptions, labour costs and global commodity price hikes continue to apply upward pressure on replacement values.

The latest RCI further illustrates that categories such as furniture and lighting (26.7%), clothing and footwear (15.6%), and window/floor furnishings (11.4%) dominate the average household contents.

Each of these areas have seen price escalations due to raw material shortages, shipping delays, and rising manufacturing costs.

2. Jewellery Defying the Trend

The price of gold has increased by 110%, which is significantly higher than the aforementioned 15% inflation over 2020 to 2024, so many would expect jewellery to become more expensive to replace. Yet the data points to the contrary.

Jewellery and watches account for 1.8% of the total Consumer Price Index (CPI), but the real story is the downward pricing trend in some of the most common claims, specifically diamond-set pieces.

Why the drop? While gold has indeed climbed in value, the diamond component is where the volatility lies. You may have heard of lab-grown diamonds; they have gained significant traction in recent years, exerting downward pressure on the cost of natural diamonds.

When you consider that the diamond is often the most expensive element of a ring or necklace, any drop in diamond prices can more than offset the increasing cost of gold.

According to ABC News, diamond prices are “plummeting”, the RapNet Diamond Index by Rapaport (a leading diamond-price authority) shows that smaller diamonds have seen a significant drop in value (26.2%) and it’s these smaller diamonds in everyday jewellery items that are the most commonly claimed.

This market shift means that the current replacement cost is often less than what it was just a few years ago.

3. Implications for Insurers

- Jewellery costs will likely continue to drop

We are seeing items being replaced for less than what they cost only two or three years ago, and as consumer acceptance for lab-grown diamonds continues to grow, this trend will likely continue.

-

Competitive advantage

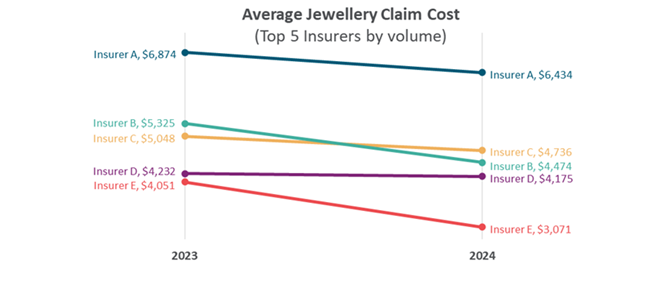

Tapping into the most current, data-driven indices (such as Sum Insured’s RCI) can give insurers a competitive edge in settling claims fairly and promptly. Most insurers have witnessed a drop in jewellery costs, presenting better claims outcomes, and an opportunity to further optimise jewellery coverage to policyholders.

Figure 2 – Most insurers have witnessed a drop in the average jewellery claim cost.

- Associated risks

Jewellery items are considered by many as an investment.

The unfortunate reality is that diamond pieces are now less valuable and prone to being the subject of insurance fraud. It's appropriate to highlight that not all cash settlement requests are fraud, but most fraudulent claims focus on cash.

There are certainly instances where a cash settlement is appropriate - but it is not necessary for the majority of claims. There are many impactful ways to help customers verify documentation and achieve positive outcomes by replacing jewellery without reverting to cash.

- Customer success

Jewellery can be a complex category and is one of the most sentimental items that customers claim.

Getting it right is important, and insurers navigating this category can have difficulties when trying to explain jewellery replacement costs.

For example, trying to explain why the exact same item can cost less than it did a few years ago can be a challenging conversation to have.

In which case it’s important to remember that prices will differ between retailers, even for the exact same item. Focus on the item description and ensure that the customer can get an item with the same specification as the original.

- Growing regulatory pressure

Australia and New Zealand have been victims of major floods, and we’re just starting to see some of the recommendations that will likely be implemented as a result of the associated claims outcomes.

Recommendations relating to the quality and reliability of expert reports and to the process of providing cash settlements are examples that received significant media interest and coverage. Although the majority of challenges raised focus on building claims, any regulatory change could be imposed on contents claims.

We saw this recently in Australia in 2022, when the obligation for insurers to provide a Cash Settlement Fact Sheet (CSFS) was implemented across claims regardless of category after the Hayne Royal Commission.

Get in touch

If your organisation hasn’t revisited its approach to contents procurement, especially for jewellery, be sure to check if it is performing in line with industry trends.

You might be missing an opportunity (or exposing yourself to unnecessary losses). Insurers can gain significant benefit from reviewing replacement costs for everything from furniture and flooring to diamond rings.

Comments

Remove Comment

Are you sure you want to delete your comment?

This cannot be undone.