The recent post-Hayne royal commission changes for general insurance broking are a step change in the operation of a typical insurance brokerage or Authorised Representative model, not only in terms of management, compliance and operations teams, but also for brokers and ARs themselves.

Overarching these fundamental operational requirements are the ‘best interest tests’ for our clients and the soon-to-be-released, newly revised NIBA code of practice.

In addition, there are the obligations of the General Insurance Code of Practice (GICOP) and the fact that we need to support target market determinations in our daily delivery of advice and products to our customers.

So, the question presents itself — how do we grow our business in such an increasingly complex environment of compliance?

Existing obligations

While not an exhaustive list, the insurance broking industry is currently expected to comply with the following regulation:

- Corporations Act

- Trade Practices Act

- Privacy Act

- Insurance Contracts Act (1973)

- ASIC RG 146 – minimum requirement to advise clients

- Financial Services Guide

- Client Duty of Disclosure

- Anti-hawking

- AFSL general obligations under s912A(1) of the Corporations Act 2001 (Corporations Act) to:

a. Do what's necessary to ensure that the financial services covered by your licence are provided efficiently, honestly and fairly (s912A(1)(a))

b. have adequate arrangements in place for managing conflicts of interest (s912A(1)(aa)); -comply with the conditions on your licence (s912A(1)(b)) comply with the financial services laws (s912A(1)(c))

c. take reasonable steps to ensure that your representatives comply with the financial services laws (s912A(1)(ca))

d. comply with the ASIC Reference checking and information sharing protocol (ASIC protocol) in relation to prospective representatives who will act as financial advisers or mortgage brokers (s912A(1)(cc))

e. have adequate financial, technological and human resources to provide the financial services covered by your licence and to carry out supervisory arrangements (s912A(1)(d));

f. maintain the competence to provide the financial services covered by your licence (s912A(1)(e))

g. ensure that your representatives are adequately trained and competent to provide those financial services (s912A(1)(f)); -

h. if you provide financial services to retail clients, have a dispute resolution system (s912A(1)(g)) and

i. establish and maintain adequate risk management systems (s912A(1)(h)).

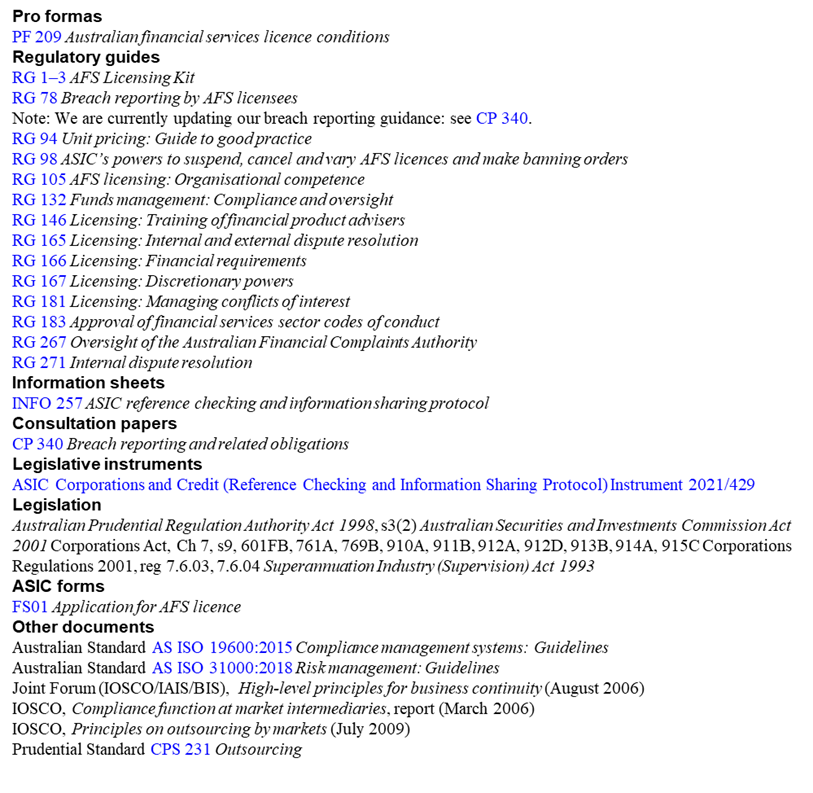

Regulatory guides are provided by ASIC to explain the above requirements and an overall typography of these is included below.

Source: RG104 AFS licensing: Meeting the general obligations (April 2020)

There's no doubt brokers have their work cut out for them.

They have to stay compliant in a very complex and demanding environment while being across a variety of client needs, risk assessments, insurance products, inclusions and exclusions, as well as managing insurer contacts and changing risk appetites, IT security and hard market impacts including premium increases.

Changes to our industry

Since 1 October, 2021 the general insurance broking industry has seen the following major changes:

- Product design and distribution obligations

- Client duty of disclosure vs duty to take reasonable care not to make a misrepresentation

- Client’s best interest — general vs personal advice

- Increased anti-hawking provisions (ASIC RG38) previously not applicable to general insurance broking

- Deferred sales model and add on insurance impacts

- Increased scrutiny on the advertising of financial services and the need to not engage in misleading deceptive advertising

- The changes to breach reporting where AFS Licensees are required to notify ASIC when a significant breach or likely significant breach has occurred

- The changes to the AFCA reporting standards and the broker code compliance committee reporting and benchmarking obligations

- APRA Connect reporting

From 1 January, 2022:

- Claims handling and settling services now require an AFS license

- Enforceable code provisions are now effected (including the new NIBA Code of Conduct when approved by ASIC) under the Hayne Commission Response Act 2020 making the codes ‘enforceable’ or ‘mandatory’

Brokers and ARs must now also consider the upcoming review of remuneration which will challenge the status quo including the amount and disclosure of commissions and soft dollar incentives (including discounted premium rates).

The most important of these changes will be acting on the concept of ‘best interests of the client’ which will see the need to choose between a general or personal advice template and take the most appropriate course of action.

This is a somewhat different approach to a blanket general advice or personal advice model, notwithstanding we have always acted in the best interests of the client.

Wider market influences

Other macro factors that continue to impact the industry include increased premiums as the result of a hardening market which must be explained to clients as well as a lack of insurer appetite for what were once considered ‘vanilla’ risks.

We have also seen a reduction in the acceptance of risk for ‘at risk’ occupations, industries, and companies, all at a time when COVID-19 has made face to face contact difficult.

The pandemic not only wreaked business interruption claims on an unprepared market but also reduced social connectedness and effective communication between brokers and their customers as well as internally between staff and product suppliers.

How do we grow?

Simply, the way to growth is being a good broker. Being trusted to add value to our clients’ business requires a good knowledge of their business and how the insurance industry can support risk transfer.

Brokers must develop risk management skills and apply these to allow options beyond risk transfer to be taken by clients such as risk management procedures, the elimination or avoidance of risks, the management of risks, the acceptance of risks and options for self-insurance.

Keeping current with the insurance market’s appetite and product offerings is critical and includes being aware of new products or non-insurance solutions such as discretionary mutuals or captive solutions.

Brokers must also be prepared to be absolutely transparent in terms of fees, remuneration and advice.

This requires being organised and efficient, being compliant and accepting compliance support through the cluster group and licensee.

We suggest that brokers always look for technical innovation, ways to reduce operating costs and ways to leverage non-value adding processes between them such as shared back office or non-income producing activities.

Paying attention to the new compliance regime and getting ahead of the curve will make the difference between those that thrive and those that do not.

Do it right now to avoid the costs and impact of procrastination. Changing or adapting the culture to allow for increased compliance oversight will give critical advantage.

Develop young talent

Finally ensure succession. Be the one to look for and develop young talent in an industry that is aging quickly and still lacks investment and the ability to support to new entrants.

A broker is more than a shopper for the lowest price.

If a broker is completely trusted to offer a range of solutions that meets a client's need, the broker will always be called upon to answer the question, ‘If we do this in our business how will it impact our risk?’

When a broker becomes the trusted advisor of a business owner, they immediately guarantee growth.

Comments

Remove Comment

Are you sure you want to delete your comment?

This cannot be undone.